The rise in rampant inflation has been affecting all Americans throughout the past few months, and the Federal Reserve has decided to raise interest rates again this year. A 75-point (.75%) increase in the most recent hike, means it will begin to affect all Americans’ bank accounts and wallets. Goods and services have been steadily increasing throughout the last year at about an 8% increase on average at the time of writing.

So how does all of this stuff affect the average citizen? First of all, when the Feds increase the interest rate, it means that the amount of money financial institutions borrow from each other also increases. This increase affects everything below the level of a financial institution (like a bank), which is pretty much everything. This includes credit card companies, mortgages, goods, services, and even jobs.

The most noticeable effect that Americans will feel is the increase in goods and services. On average, grocery bills have increased by 16% since the beginning of the year, which makes it harder for people to budget out their food. The same goods and services one bought before might cost more, making it harder to save up or budget if people have obligations like a car or home payments.

Another noticeable effect will be the interest rates on credit card payments. Most credit cards work on a variable interest rate, so it means that the increase in the Fed interest rate also affects people’s credit card payments. This may not apply to all credit cards, but it does affect most of them. It may be prudent to start paying off the credit cards more aggressively to avoid getting hammered by the increased interest rates.

Mortgages, old and new, will also be affected by the increase. People who already have mortgage payments may not see much of a difference if they have a fixed-rate mortgage, which applies to most homeowners. However, those who have an adjustable-rate mortgage (ARM) will see a change in their monthly payments as the interest rate of these mortgages is affected by the current stability of the economy, including the Fed interest rate hike.

Getting a new mortgage will also be a problem for those who are home shopping. In the past year, the average rate of a mortgage has risen from 3% to 6%, which is double. For example, looking at a home with a $300,000 price tag at a 3% interest rate would have a monthly payment of $1,265; however, this year with the 6% average interest rate, that same mortgage would now have a $1,799 monthly payment. That’s a $534 difference in monthly payments! So it may not be a good idea to grab a mortgage currently. This same logic also applies to any auto loans.

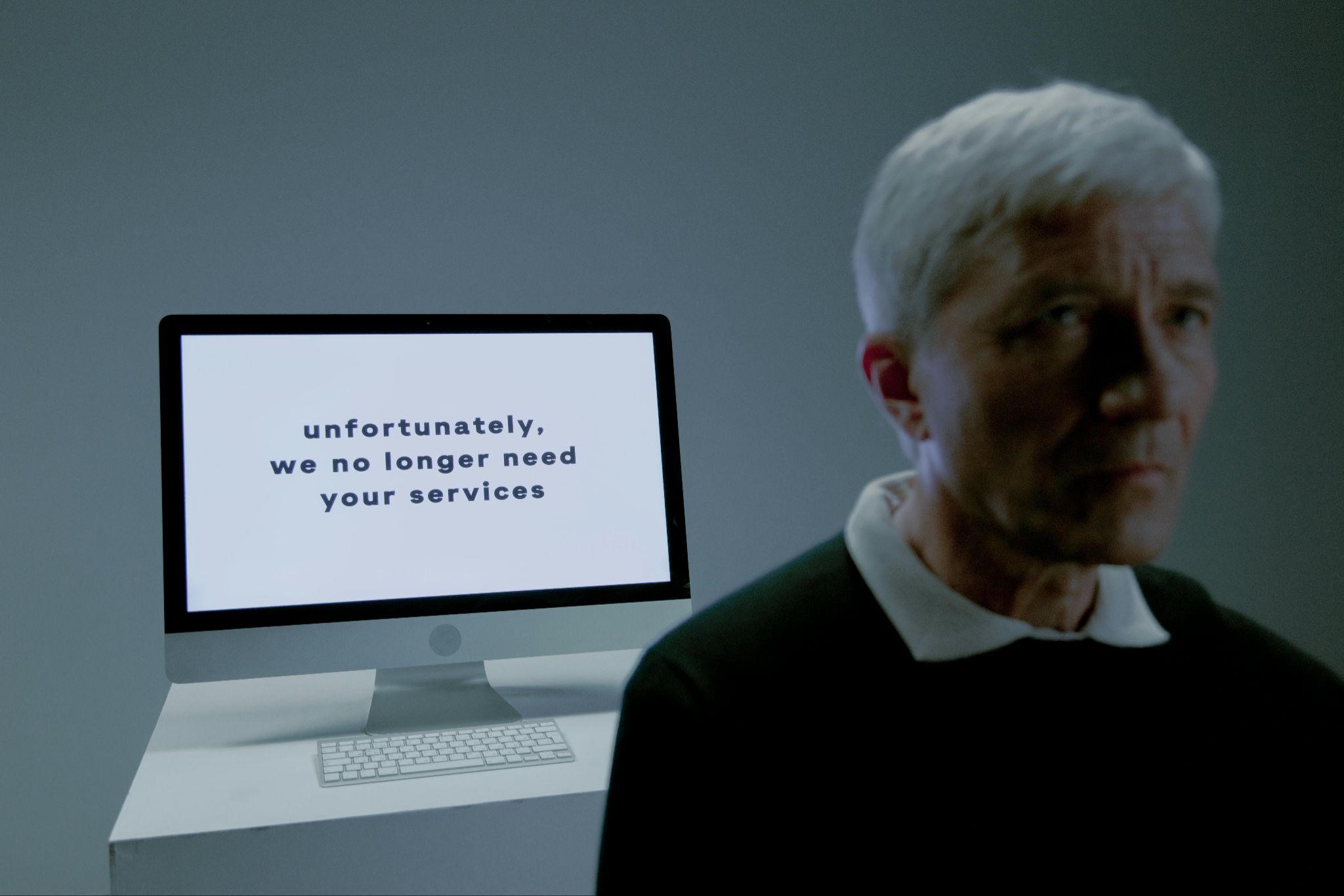

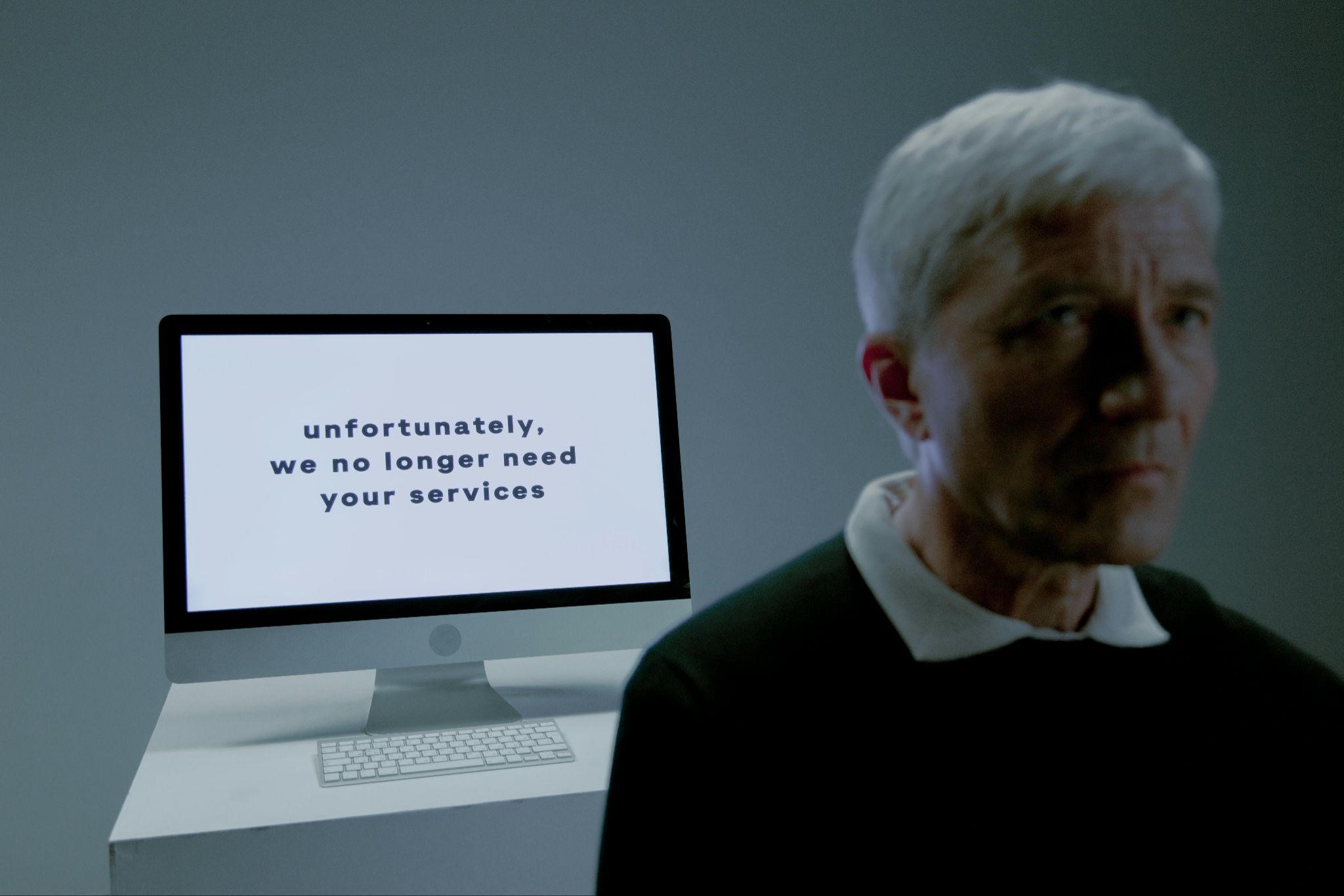

Finally, with financial instability in the markets, stocks and jobs will also be affected. The stock market took a major downturn at the beginning of June 2022, and the after effects of such a plunge will affect job growth and stability as well. Most companies are still trying to cut costs by looking at their labor force and pause all hiring.

With all of this instability in the markets and economy, it is becoming more imperative that people budget their finances to be a little tighter. Keeping an eye on credit card payments and ways to reduce costs will help with debt in the long run.

We also invite you to click on the following link to Interest: Car Warranty Scams: The Relentless Robocalls

We also invite you to click on the following link to see our reviews on yelp.