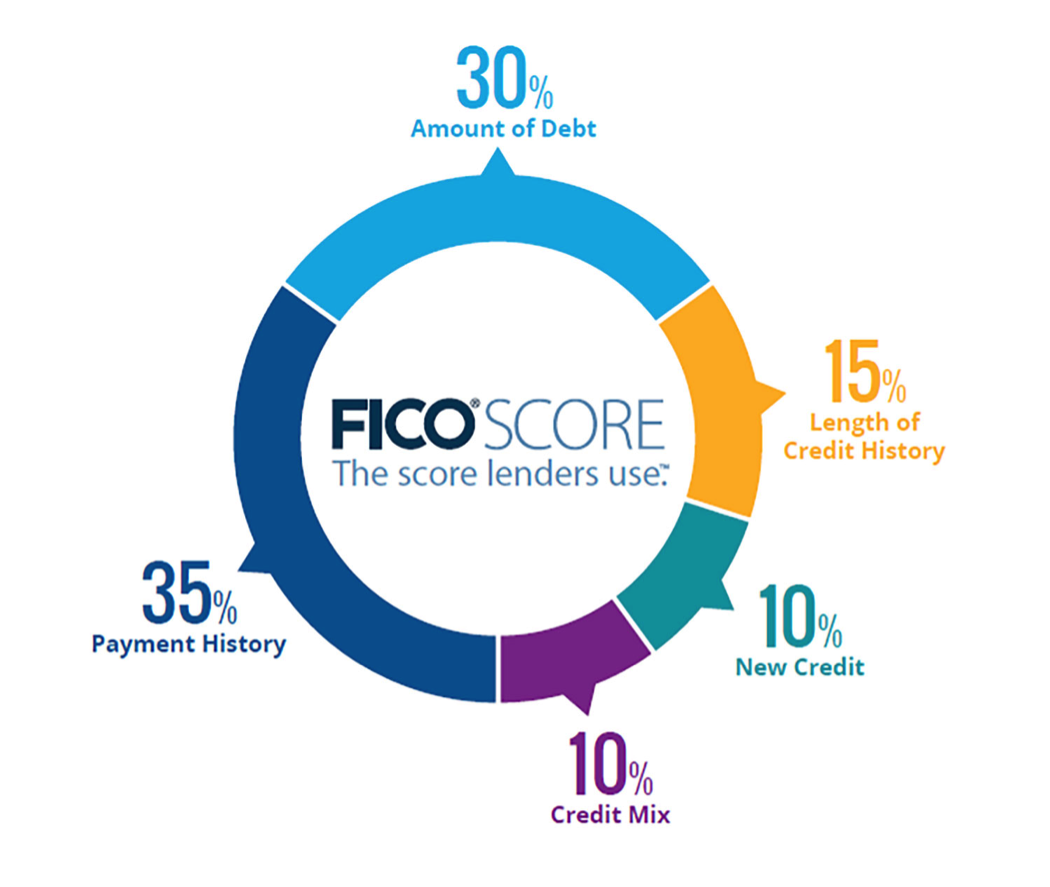

What is a FICO score and how does it work? This is a concern that puzzles even people seasoned in credit. The score is out of 850 and the higher the better… but where does that number come from? Luckily, FICO is more open about how their scores are calculated than other credit lenders, and show that your score boils down to five major facets with varying importance:

1. Payment History – 35%

The most important factor of a FICO score is the history you have with paying your accounts on time. As unfair as it may be given circumstances, negative items can remain for as long as 7 years! Credit agencies look at you chiefly like a model of predictive behavior: late payments in the past suggest you won’t pay on time. Thankfully, positive payment history remains even longer, as high as 10 years.

2. Amount of Debt Owed – 30%

The second most influential asset is how much remaining balance you have. Owing more is considered a risk to opening a new credit because it suggests you’ll behave similarly with the new account by racking up debt. Keep your credit card balances below 30% of your limit for the best results!

3. Length of Credit History – 15%

It’s also important to show how you can handle an account for long periods of time. The longer ago a current account was started, the better.

4. New Credit – 10%

Being able to open recent lines of new credit is proof to credit bureaus that creditors find you trustworthy.

5. Variety in Credit – 10%

It’s also best if your credit accounts are varied, having a mix of credit cards, retail accounts, mortgages, or auto loan shows you’re managing a lot of different accounts well.