Credit card fraud affects 1 out of 10 Americans every year, so how do you prevent yourself from becoming a victim? Credit fraud can come in various forms and all of them can negatively affect your credit, your financial history, and may even cost you money in the future. An example of fraud is when a thief is able to get your credit card information and use it to buy things. Even worse, if a thief has stolen your personal information such as social security number or other identifying information, they can open a new line of credit under your name without you even knowing! Here are several tips to keep in mind to prevent any sort of credit fraud:

If you get a new card or stop using an old card, it’s important to completely destroy it so that no one is able to discern any information from it. Even if you believe that the card no longer works, is frozen, or expired, it does not matter: Destroy that card! Thieves can still use expired credit card information for their own benefit. Cutting up the card into tiny pieces is a simple and effective way to eliminate the card, but you can always take it a step further. Make sure to cut the chip, the magnetic strip, and pertinent info into little pieces. Try not to leave big chunks behind. Using a paper shredder can be a handy way to effectively cut up your credit card. Secondly, you can also scatter the pieces into multiple trash cans and waste bins around the home for extra security.

Scammers and thieves are always evolving their tactics to get information from their victims, so it’s important to look out for any scam calls or phishing emails that may try to get personal information. Be aware that major financial institutions and retailers will not call or email you to try and glean any personal information. They usually ask for such info only if they need it for a transaction you requested. Beware of any unsolicited robocalls as well as they may try to pretend to be with a major financial institution or make you think that they are there to serve you.

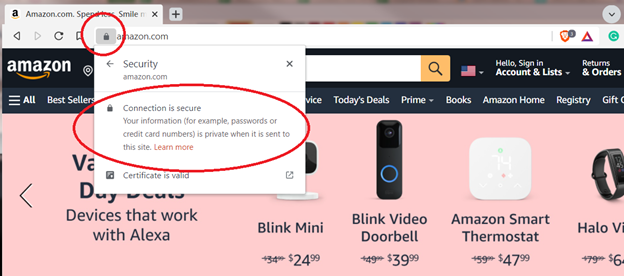

When shopping online, it’s important to check if the retailer is a trusted source and not a scam site. This can be verified by doing a simple look-through on a search engine. But more importantly, when entering any sort of personal or financial information, it’s imperative that the site has some form of online encryption. Websites like Amazon or PayPal will have something called SSL encryption to help protect their customers from thieves who may be sniffing web traffic for pertinent information. The best way to tell is to use a trusted web browser and check if the site has encryption on it. This information is usually located near the URL bar of the browsers like so:

As an extra layer of security to prevent credit fraud, every credit bureau offers a fraud alert service through their websites. This fraud alert is a way for consumers to prevent other people such as thieves from opening a new line of credit in the consumers’ name. This is especially important after losing a wallet, suspecting that someone stole personal information, or misplacing personal documents. You can place a fraud alert with the credit bureaus with the following links:

There are multiple online services that can also provide a theft or credit monitoring service. These services charge a premium to monitor your credit history and alert you when something happens: score drops, a new line of credit opens, or a collection account pops up. Some of these services are so sophisticated that they can even monitor the dark web to see if your personal information pops up anywhere to alert you ahead of time of possible fraud. Some credit card companies offer free identity theft protection if you have an open account with them. Other times, you may need to sign up for a service like this. We recommend either Smart Credit or Identity IQ for both credit and theft monitoring.

If you have any questions, feel free to give us a call at 877-212-2450!

We also invite you to click on the following link to see our reviews on yelp.

You may also like: Keeping Track of Debt: Should I Consolidate?